Inherited roth ira rmd calculator

My Social Security calculator. This tax information is not intended to be a.

Required Minimum Ira Distributions Tax Pro Plus

Inherited IRA RMD Calculator.

. Generally a designated beneficiary is required to liquidate the account by the end of the 10th year following the year of death of the IRA owner this is known as the 10-year rule. Your RMD from the account will be calculated each year based on your own remaining life expectancy from the Single Life table in IRS Publication 590-B Inherited IRA. The RMD rules are different for each choice so consider your options carefully.

An inherited IRA is an individual retirement account opened when you inherit a tax-advantaged retirement plan including an IRA or a retirement-sponsored plan such as a 401k following the death. A Roth IRA is different. If you inherit a Roth IRA as a spouse you can withdraw any or all of the account tax-free provided the account has existed for at least five years.

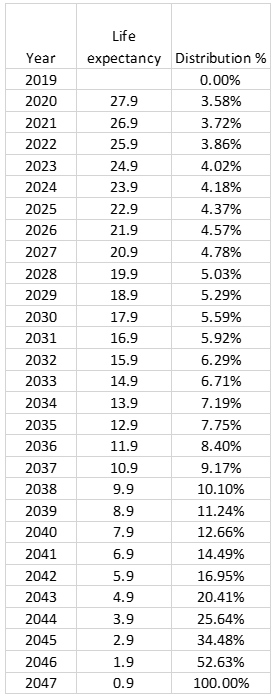

Sometimes FMV and RMD calculations need to be adjusted after December 31. Generally taxable to the beneficiaryies and must be included in their gross income. However if you were 70 12 by 2019 you still had to take your first RMD by April 1 2020.

Withdrawals made before age 59 12 are subject to a 10 early withdrawal penalty. Helps IRA beneficiaries calculate the required minimum distribution RMD amount that must be withdrawn this calendar year from an inherited IRA if applicable. A Roth IRA inherited from a spouse can be treated as if it were the beneficiarys own account.

Inherited SEP or SIMPLE IRA youll need to take an RMD. For example a 40-year-old non-spouse beneficiary who inherited a 1 million traditional IRA when the stretch option was allowed would have been required to withdraw a 23000 RMD the first year. Long-Term Care Menu Toggle.

You should keep an acknowledgement of the donation from the charity for your tax records. RMD for an inherited IRA or a 72s payment for an inherited non-qualified contract. If the Roth IRA came from anyone else however the beneficiary has.

For Inherited IRAs or Inherited Roth IRAs the QCD will be reported as a death distribution. RMD Rules for Inherited IRAs. This means that if you inherit a Roth IRA any distributions you take are not subject to taxation.

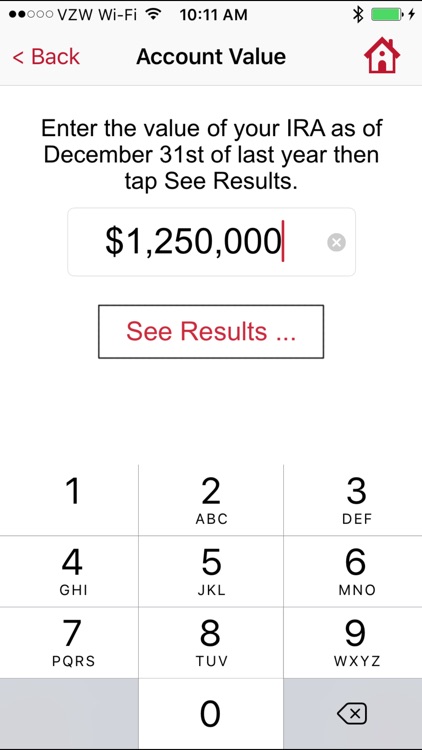

Inherited IRA Inherited IRAs are specifically designed for retirement plan beneficiariesthose who have inherited an IRA or workplace savings plan such as a 401k. Use our Beneficiary RMD calculator This tax information. Please consult a tax advisor to learn more.

Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from TD Ameritrade. Generally you dont have to worry about taxes on withdrawals from a Roth as long as. If you dont take your RMD you could face a penalty of up to 50 of what the IRS says you should have withdrawn.

A Roth IRA withdrawal wont satisfy your RMD requirement. Rules for Inheriting a Roth IRA. Roth IRA owners.

Qualified annuities must also follow the required minimum distribution RMD rules. Required Minimum Distribution - RMD. In some cases a final distribution must be made from an inherited IRA.

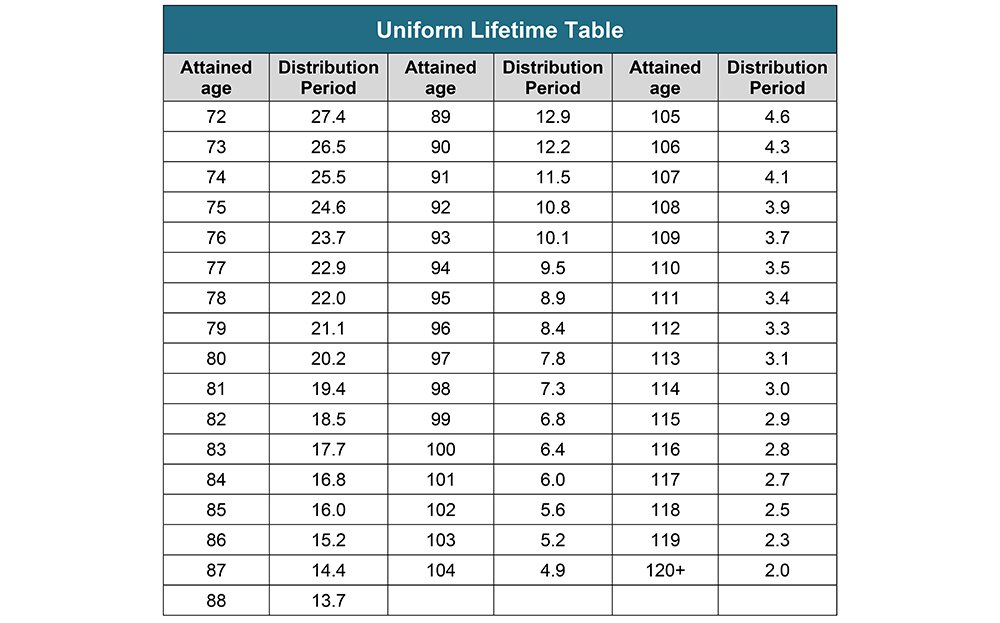

The SECURE ACT of 2019 raised the age for taking an initial RMD to 72 beginning in 2020 for individuals not already 70½ the previous age was 70½. RMDs are not required with Roth IRAs unless you inherit a Roth IRA from a non-spouse. You transfer the assets into an Inherited Roth IRA held in your name.

This means the new owner can take tax-free withdrawals at his or her option. And be sure to start taking distributions before you turn 705. Otherwise the same rules apply.

If you inherited an IRA from your spouse you have the choice of either moving the money into your own IRA or into an inherited IRA. Get a FREE Quote. You must begin taking RMDs from a traditional IRA by April 1 of the year after you turn 72 the old threshold of 70½ still applies if you hit that age by Jan.

In some situations the RMD rules for beneficiaries of IRA owners who died before 2020 are different than the RMD rules for beneficiaries of IRA owners who dies in 2020 and beyond. Required Minimum Distributions RMDs are mandatory and distributions must begin no later than 1231 of the year following the year of death. A required minimum distribution RMD is the amount that traditional SEP or SIMPLE IRA owners and qualified plan participants must begin distributing from.

If youre receiving the Roth IRA from your spouse dont take distributions until you turn 595 lest you get hit with the 10 penalty tax. You will receive an IRS Form. For an inherited IRA received from a decedent who passed away after December 31 2019.

Roth IRAs RMDs. Roth individual retirement accounts IRAs are powerful tools for building tax-free savings in retirement. As a beneficiary you cant make additional contributions but with an Inherited IRA the funds can remain tax-deferred and you can generally withdraw money right away.

A QCD is reported by your IRA custodian as a normal distribution on IRS Form 1099-R for any non-Inherited IRAs. Get the facts on inherited IRA rules and required minimum distribution RMD rules to avoid financial penalties. If you consolidate the money into your IRA then the regular RMD rules apply.

Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors. That kind of sounds like a Roth account but theres a catch. A non-qualified annuity on the other hand is funded using after-tax dollars.

Like a traditional 401kand unlike a Roth IRAyou do have to take a required minimum distribution RMD from a Roth 401k unless youre still working for that employer. Savers can choose either a Roth IRA or a traditional IRA for their rollover. An Inherited IRA or a Beneficiary IRA is an account that is opened when someone inherits an IRA or employee-sponsored retirement plan after the death of the original owner.

Inherited RMD calculation methods. If you are the beneficiary of a Roth IRA your withdrawals may not be taxable. If you had a transfer or rollover to your Schwab retirement accounts a conversion from a traditional IRA to a Roth IRA and back or any correction for security price after year-end please call us at 877-298-8010 so we can recalculate your RMD.

If youve got one already or plan to open one soon use our Roth IRA calculator to see. Move the money into your own IRA. Choose a Traditional or Roth IRA according to the type of IRA you have inherited.

Contributions are rolled over from a workplace retirement plan such as a 401k or 403b. Withdrawals from Inherited Roth IRA. Note that the SECURE Act raised the RMD age from 70 12 to 72.

Avoid This Rmd Tax Trap Kiplinger

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Calculator Required Minimum Distributions Calculator

The Inherited Ira Portfolio Seeking Alpha

Required Minimum Distributions For Retirement Morgan Stanley

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

Where Are Those New Rmd Tables For 2022

Ira Rmd By Symons Software Solutions Llc

Required Minimum Distribution Rules Sensible Money

How Required Minimum Distributions Work Merriman

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Inherited Ira Rmd Calculator Td Ameritrade

Required Minimum Distributions Tax Diversification

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Rmd Table Rules Requirements By Account Type

Your Search For The New Life Expectancy Tables Is Over Ascensus

What Is A Required Minimum Distribution Rmd Preparing For Retirement Retirement Planning Required Minimum Distribution